Facing surgery without health insurance coverage in the United States presents a daunting financial challenge. With the cost of an average hospital stay reaching over $13,000 in 2021 and major surgeries like heart valve replacements or spinal fusions costing into the six figures, the financial implications are significant. These figures only touch on the initial costs, excluding the additional expenses for pre-and post-operative care, medications, and unforeseen complications which can further inflate the financial burden. Moreover, the pervasive issue of medical debt affects a broad swath of the population, with many struggling to manage bills from hospital stays, emergency services, and other medical necessities. This financial strain is a reality for both the insured, facing high deductibles and out-of-pocket expenses, and the uninsured alike.

In response to these challenges, this guide explores a multi-faceted approach to managing surgical costs without insurance. It will cover practical strategies such as negotiating with healthcare providers to reduce surgery costs, seeking financial assistance through charitable programs and non-profit organizations, navigating government and state-sponsored healthcare programs for those eligible, and leveraging online fundraising platforms to gather community support. Through a combination of these strategies, individuals facing surgery without insurance can find pathways to manage the financial demands of their medical care, providing a comprehensive toolkit for navigating this complex landscape.

Direct Negotiation and Payment Plans with Healthcare Providers

Navigating the financial aspects of surgery without insurance requires a proactive approach. By directly engaging with healthcare providers and exploring payment options, individuals can significantly reduce the financial burden of medical procedures.

1. Negotiating Surgery Costs with Hospitals and Surgeons

-

Research Standard Pricing: Before initiating negotiations, research the typical costs for the surgery you need. Websites like Healthcare Bluebook can provide benchmark prices, giving you a solid foundation for discussions.

-

Ask for Itemized Bills: Request an itemized bill from the hospital or surgical center. This allows you to see each charge in detail and identify any potential errors or charges that can be disputed.

-

Negotiate Directly with the Provider: Approach the billing department with your research in hand. Be honest about your financial situation and ask if they can lower the cost or remove certain charges. Sometimes, hospitals have lower rates for uninsured patients that are not publicly advertised.

-

Seek a Payment Reduction: Inquire if the hospital offers discounts for prompt payment or for patients experiencing financial hardship. Some institutions provide significant reductions if you can afford to pay a lump sum upfront.

-

Utilize Non-profit Advocates: Organizations such as the Patient Advocate Foundation can offer guidance and support in negotiating medical bills, leveraging their expertise to potentially secure better terms.

2. Arranging Payment Plans

-

Communicate Your Financial Limits: Clearly outline what you can realistically afford to pay monthly without stretching your budget too thin. This honesty helps in reaching a mutually agreeable plan.

-

Understand the Terms: Before agreeing to any payment plan, make sure you understand all the terms, including any interest rates applied, the duration of the plan, and any penalties for late payments.

-

Request a No-Interest Plan: Some hospitals offer interest-free payment plans for a certain period. Ask if such options are available and what criteria need to be met to qualify.

-

Get Everything in Writing: Once you've agreed on a payment plan, ensure all the details are documented in writing. This protects both you and the healthcare provider and clarifies the expectations on both sides.

-

Monitor Your Bills and Payments: Keep meticulous records of all payments made and regularly review your outstanding balance. If your financial situation changes, contact the billing department to discuss adjusting your payment plan.

Seeking Charitable Programs and Non-Profit Assistance

Accessing medical care, especially surgeries without insurance, can be financially challenging. However, charitable programs and non-profit organizations offer a beacon of hope, providing essential support to those in need.

1. Identifying and Applying for Charity Care Programs Offered by Hospitals

-

Research Hospital Policies: Start by researching hospitals in your area to identify which ones offer charity care programs. Most hospitals have this information available on their websites or you can contact their billing department directly.

-

Understand Eligibility Requirements: Charity care programs often have specific eligibility criteria based on income level, residency, and the type of medical service required. Ensure you meet these criteria before applying.

-

Gather Necessary Documentation: Applying for charity care typically requires documentation of your financial situation, including income statements, tax returns, and proof of residency. Prepare these documents in advance to streamline the application process.

-

Submit a Detailed Application: Complete the application thoroughly, providing detailed information about your financial situation and the medical treatment you need. Be honest and transparent to increase your chances of approval.

-

Follow-up: After submitting your application, follow up with the hospital’s billing department to check on the status of your application and provide any additional information if needed.

2. Leveraging Assistance from Non-Profit Organizations

-

Identify Relevant Organizations: Look for non-profits that focus on your specific medical condition or the type of surgery you need. Organizations such as the Patient Access Network Foundation, The HealthWell Foundation, and disease-specific groups like the American Cancer Society may offer grants or assistance.

-

Check Eligibility and Requirements: Each organization has its own eligibility criteria and application process. Review these carefully to ensure you qualify for financial assistance programs.

-

Apply for Grants or Assistance: Complete the application process as directed by the organization. This may involve providing medical documentation and detailed information about your financial situation.

-

Explore Additional Resources: In addition to direct financial assistance, some organizations offer resources such as counseling, guidance on navigating healthcare, and access to discounted medication programs.

-

Engage with Community Support: Many non-profit organizations also provide forums or support groups where you can connect with others in similar situations. These communities can offer invaluable emotional support and practical advice on managing your condition and medical costs.

Utilizing Government and State-Sponsored Healthcare Programs

Navigating the landscape of government and state-sponsored healthcare programs can provide a lifeline for individuals without insurance in need of surgical procedures. Understanding and accessing these resources can significantly alleviate the financial burden of medical care.

1. Medicaid for Those with Low Income

Medicaid serves as a critical program for individuals and families with low income, offering comprehensive healthcare coverage, including surgeries and related medical services.

-

Understand Medicaid Eligibility: Medicaid eligibility is primarily based on income, and the specific thresholds can vary by state. It's important to check your state's Medicaid website or the federal Medicaid website for the most current eligibility criteria.

-

Application Process: Applying for Medicaid can be done online through the Health Insurance Marketplace or directly through your state's Medicaid agency. The application will require detailed information about your financial situation, household size, and income.

-

Required Documentation: Be prepared to provide proof of income, identity, and residency, among other documents, to support your application. This documentation helps verify your eligibility for the program.

-

Seek Assistance if Needed: Many states offer assistance through local health departments, non-profits, and community health centers to help individuals navigate the Medicaid application process. Utilizing these resources can simplify the application process and improve your chances of approval.

2. Investigating State-Specific Healthcare Assistance Programs

In addition to Medicaid, many states offer their own healthcare assistance programs designed to support individuals who may not qualify for Medicaid but still cannot afford insurance.

-

Research State-Specific Programs: Start by researching programs available in your state. This can include state-funded health insurance programs, high-risk insurance pools for individuals with pre-existing conditions, or programs specifically designed to provide financial assistance for medical procedures.

-

Eligibility and Application: Each state program has its own set of eligibility criteria and application processes. Information can typically be found on state health department websites or by contacting the program directly.

-

Comprehensive Coverage Options: Some state programs offer coverage that is comparable to Medicaid, covering a wide range of healthcare services, including surgeries. Others might offer more limited assistance, focusing on specific types of care or populations.

-

Utilize Health Insurance Navigators: Many states provide health insurance navigators or counselors who can guide you through the process of applying for state-sponsored programs. These experts can help clarify eligibility requirements, assist with paperwork, and identify the best program for your needs.

Online Fundraising as a Tool for Surgery Financing

In an era where medical expenses can quickly become overwhelming, online fundraising has emerged as a powerful tool for individuals facing surgery without insurance. It provides an accessible platform for sharing your story and garnering financial support from a wide network of friends, family, and even strangers moved by your situation.

1. Choose the Right Platform

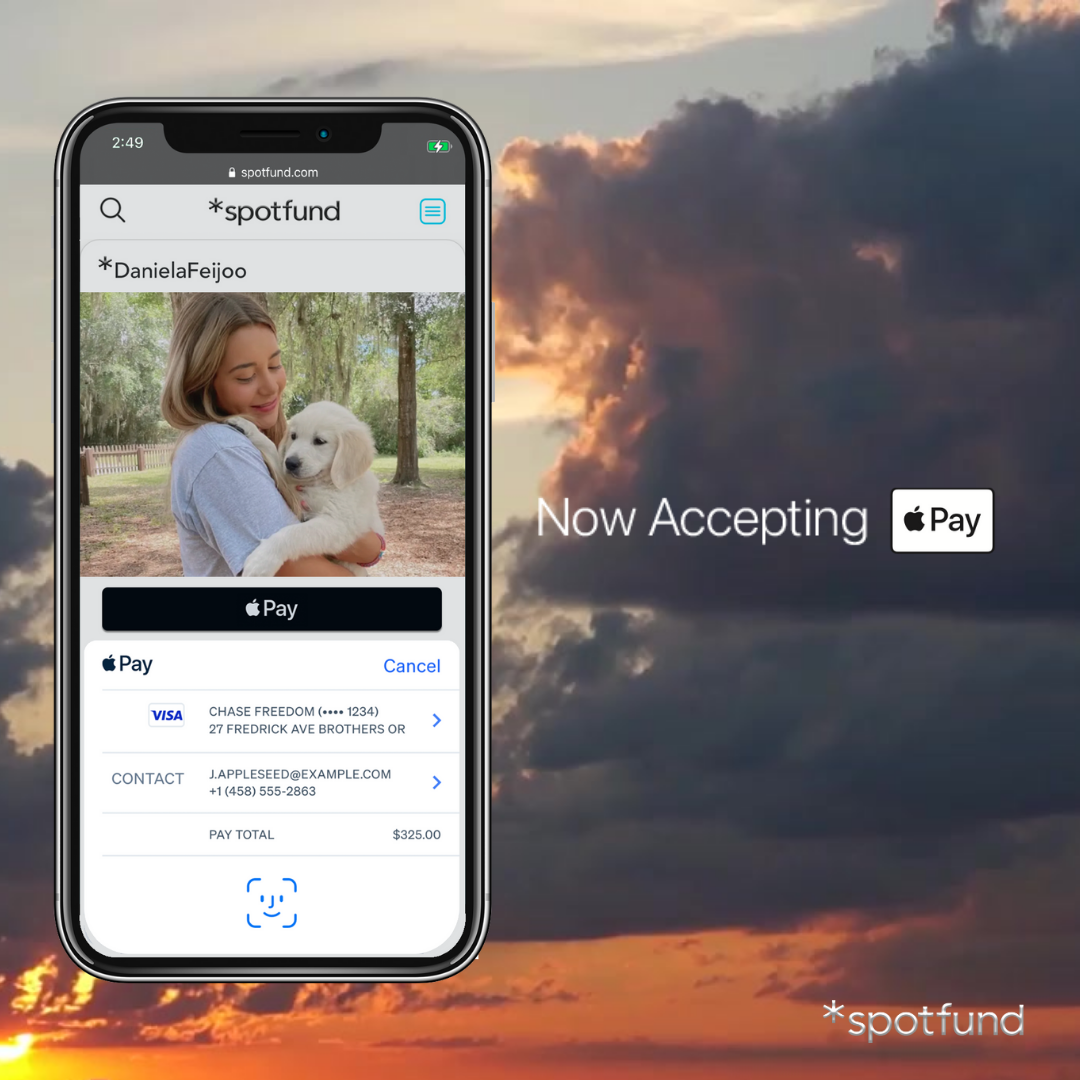

Evaluate popular online fundraising platforms like GoFundMe, Kickstarter, or *spotfund, focusing on their fees, ease of use, and the type of support they offer. Some platforms are more tailored to medical fundraising, offering features and communities specifically geared towards health-related campaigns.

In the realm of options, *spotfund stands out, particularly for those aiming to fund healthcare expenses and major surgery. It distinguishes itself by offering:

-

No Platform Fee: *spotfund operates without charging a platform fee, ensuring that a greater portion of the funds raised goes directly towards the cause.

-

Social Media Integration: The platform is designed to seamlessly integrate with social media, facilitating easy sharing and promotion of your campaign across networks.

-

Real-Time Tracking: Campaign organizers can monitor donations as they come in, providing a transparent overview of fundraising progress.

-

Safe Payment Methods: Ensuring donor confidence, *spotfund employs secure payment methods, safeguarding personal and financial information.

-

Direct Donor Acknowledgment: The platform's dashboard allows for direct email communication with donors, making it easy to express gratitude and maintain engagement.

-

Quick Withdrawal of Funds: *spotfund offers the convenience of withdrawing funds within 1 business day after reaching your fundraising goal, providing timely access to the funds when they are most needed.

Considering its comprehensive features tailored to streamline and enhance the fundraising process, *spotfund emerges as a highly recommended choice for those seeking to cover medical expenses through online fundraising. Create a fundraising campaign and raise money for your hospital bill!

2. Setting up a Successful Online Fundraising Campaign

Creating a successful online fundraising campaign involves several key steps, from crafting a compelling narrative that resonates with potential donors to setting a realistic goal.

-

Craft Your Story: Your campaign should tell your story in a way that connects emotionally with readers. Be transparent about your situation, the surgery you need, and the financial challenges you're facing. Include details about the impact this surgery will have on your life and the lives of your loved ones.

-

Set a Realistic Goal: Estimate the total cost of your surgery, including pre-and post-operative care, and set your fundraising goal accordingly. Be realistic and transparent about how the funds will be used, as this can increase donors' trust and willingness to contribute.

-

Use High-Quality Images and Videos: Visuals can significantly enhance your campaign's appeal. Include high-quality photos or even a video message explaining your situation. This personal touch can make a big difference in how people perceive and react to your campaign.

3. Promoting Your Fundraiser to Maximize Donations

Once your campaign is set up, promoting it effectively is crucial to reaching your fundraising goal. Here are some strategies to help spread the word and encourage donations:

-

Leverage Social Media: Share your campaign on Facebook, Twitter, Instagram, and other social media platforms. Use hashtags, tag friends and family, and ask them to share your campaign as well. Regular updates about your condition or the fundraising progress can keep the momentum going.

-

Engage Your Community: Beyond social media, consider reaching out to your local community through churches, community centers, and local newspapers or radio stations. Personal connections and community support can be incredibly powerful in driving donations.

-

Organize Fundraising Events: Depending on your ability and resources, consider organizing local fundraising events like bake sales, charity runs, or benefit concerts. These can not only raise money but also increase the visibility of your campaign.

-

Thank Your Donors: Show appreciation for every donation, no matter the size. A simple thank you message can make donors feel valued and more likely to spread the word about your campaign.

Preparing for the Financial Impact of Surgery

The financial journey of undergoing surgery without insurance involves meticulous planning and management to ensure that the burden does not become unmanageable. Understanding and preparing for both the immediate and long-term financial impacts are crucial steps in this process.

1. Budgeting for Surgery-Related Expenses

Budgeting for surgery encompasses more than just the cost of the procedure itself. It's essential to consider all related expenses to avoid unexpected financial strain.

-

Estimate Total Costs: Begin with the cost of the surgery and then add estimated expenses for pre-surgery consultations, post-operative care, medications, and any required follow-up visits or physical therapy.

-

Plan for Hidden Costs: Don't overlook potential hidden costs such as travel to and from the medical facility, lodging if the hospital is far from home, childcare during recovery, and loss of income if you're unable to work during recovery.

-

Create a Savings Plan: Once you have an estimate of the total cost, create a savings plan. Start setting aside money as early as possible, considering adjustments to your budget to accommodate this extra savings need.

-

Explore Payment Options: If the hospital or surgical center offers payment plans, consider how this option fits into your budget. Ensure the monthly payments are manageable and that you understand any interest rates or fees involved.

2. Managing Post-Surgery Financial Obligations and Avoiding Debt

After surgery, managing your finances carefully can help prevent debt from becoming overwhelming.

-

Monitor Medical Bills: Keep track of all medical bills and payments. Request itemized bills to review for accuracy and dispute any charges that seem incorrect.

-

Communicate with Healthcare Providers: If you're struggling to pay bills, communicate with your healthcare providers or their billing departments. Many are willing to negotiate lower payments or set up extended payment plans.

-

Prioritize Expenses: Prioritize your spending to focus on essential expenses. This might mean cutting non-essential spending or finding ways to reduce fixed expenses temporarily.

-

Seek Financial Counseling: Consider consulting with a financial counselor or advisor, especially one familiar with medical debt. They can offer strategies for managing debt, improving your credit score, and potentially consolidating debt to make payments more manageable.

Facing surgery without health insurance requires a multi-faceted strategy, including negotiating costs, seeking charitable aid, and utilizing government programs. The community and specialized platforms offer crucial support. *spotfund, with its no-fee structure and user-friendly design, stands out as a valuable resource for fundraising. Embrace the collective strength of community support through *spotfund and move closer to your healthcare goals.

Start your *spotfund campaign to navigate the financial hurdles of surgery with community support.