Medical expenses can be a major source of financial stress for individuals and families. From unexpected accidents to ongoing medical conditions, the costs of healthcare can add up quickly and lead to debt and financial hardship. Therefore, many people want to know what is the best way to raise money for medical expenses. Fortunately, there are many strategies and resources available to help raise money for medical treatment expenses. In this article, we'll explore some of the best ways to fund your healthcare needs and protect your financial well-being.

Understanding Medical Expenses

Before we dive into the various methods for medical fundraising to raise money, it's important to understand the different types of medical expenses and how they can impact your finances.

Medical and healthcare bills can be unpredictable and often come at the most unexpected times. They can range from routine check-ups to emergency surgeries and hospital stays. The rising cost of healthcare has made it increasingly difficult for families to manage these expenses.

The Rising Cost of Healthcare

Medical costs have been rising steadily in recent years and can vary greatly depending on the type of care needed. Hospital stays, surgeries, and prescription medications can all be extremely expensive, and it's not uncommon for families to face bills of thousands or even tens of thousands of dollars.

One of the reasons for the rising cost of healthcare is the increasing demand for medical services. As the population ages and chronic diseases become more prevalent, the demand for medical care continues to grow. This has put pressure on healthcare providers to increase their prices to keep up with the demand.

Another factor contributing to the rising cost of healthcare is the cost of new medical technologies and treatments. While these advancements have led to improved patient outcomes, they often come at a steep price.

Insurance Coverage and Limitations

While insurance can help alleviate some of the financial burdens, it's important to understand the limitations of your coverage. Many insurance plans have deductibles, copays, and other out-of-pocket costs that can still be quite high. Additionally, some treatments and services may not be covered at all.

It's important to review your insurance policy regularly to ensure that you understand what is covered and what is not. This can help you plan for potential medical expenses and avoid any surprises.

Out-of-Pocket Expenses

For those without insurance or with limited coverage, out-of-pocket expenses can be especially difficult to manage. These costs can include everything from doctor's appointments to medical equipment and supplies, and can quickly add up.

One way to manage out-of-pocket expenses is to negotiate with healthcare providers for lower prices. Many providers are willing to work with patients to find a solution that works for both parties.

Another option is to look for financial assistance programs. Many hospitals and clinics offer financial assistance to patients who meet certain income requirements.

1. Personal Savings and Financial Planning

One of the most effective ways to prepare for medical expenses is to build up your personal savings and create a solid financial plan. Here are some strategies to consider:

Building an Emergency Fund

Having a dedicated emergency fund can be a lifesaver when unexpected medical bills arise. Experts recommend having three to six months' worth of expenses saved up in case of emergencies. This can be especially important for those who are self-employed or have a fluctuating income.

When building an emergency fund, it's important to consider your current expenses and how they may change in the future. For example, if you plan on starting a family soon, you may need to save more money to prepare for potential medical expenses related to pregnancy and childbirth.

Another important factor to consider is where to keep your emergency fund. While a traditional savings account is a safe option, it may not offer the highest interest rates. Consider looking into high-yield savings accounts or money market accounts to maximize your savings.

Budgeting for Medical Expenses

When creating a budget, it's important to factor in the potential costs of medical expenses. This can include regular check-ups, prescription medications, and emergency care. By planning ahead and budgeting for these expenses, you can better prepare for unexpected bills.

One way to budget for medical expenses is to estimate the average cost of healthcare in your area and allocate a certain amount of money each month toward those expenses. It's also important to keep track of your medical expenses throughout the year, so you can adjust your budget accordingly.

Additionally, consider looking into healthcare cost-sharing ministries or programs that offer discounted rates for medical services. These options may be a more affordable alternative to traditional health insurance.

2. Crowdfunding and Online Fundraising

Crowdfunding and online fundraising sites have revolutionized the way people raise money for various needs, including medical expenses. These platforms have enabled people to raise funds quickly and efficiently, without having to go through the traditional methods of medical fundraising. With that said, here are some tips for making the most of these resources:

Choosing the Right Platform

When it comes to choosing the right crowdfunding and fundraising platform, there are many options available. Some of the most popular platforms include GoFundMe, *spotfund, and Indiegogo. It's essential to do your research to find a platform that aligns with your goals and values. Consider the fees, rules, and regulations of each platform before making a decision.

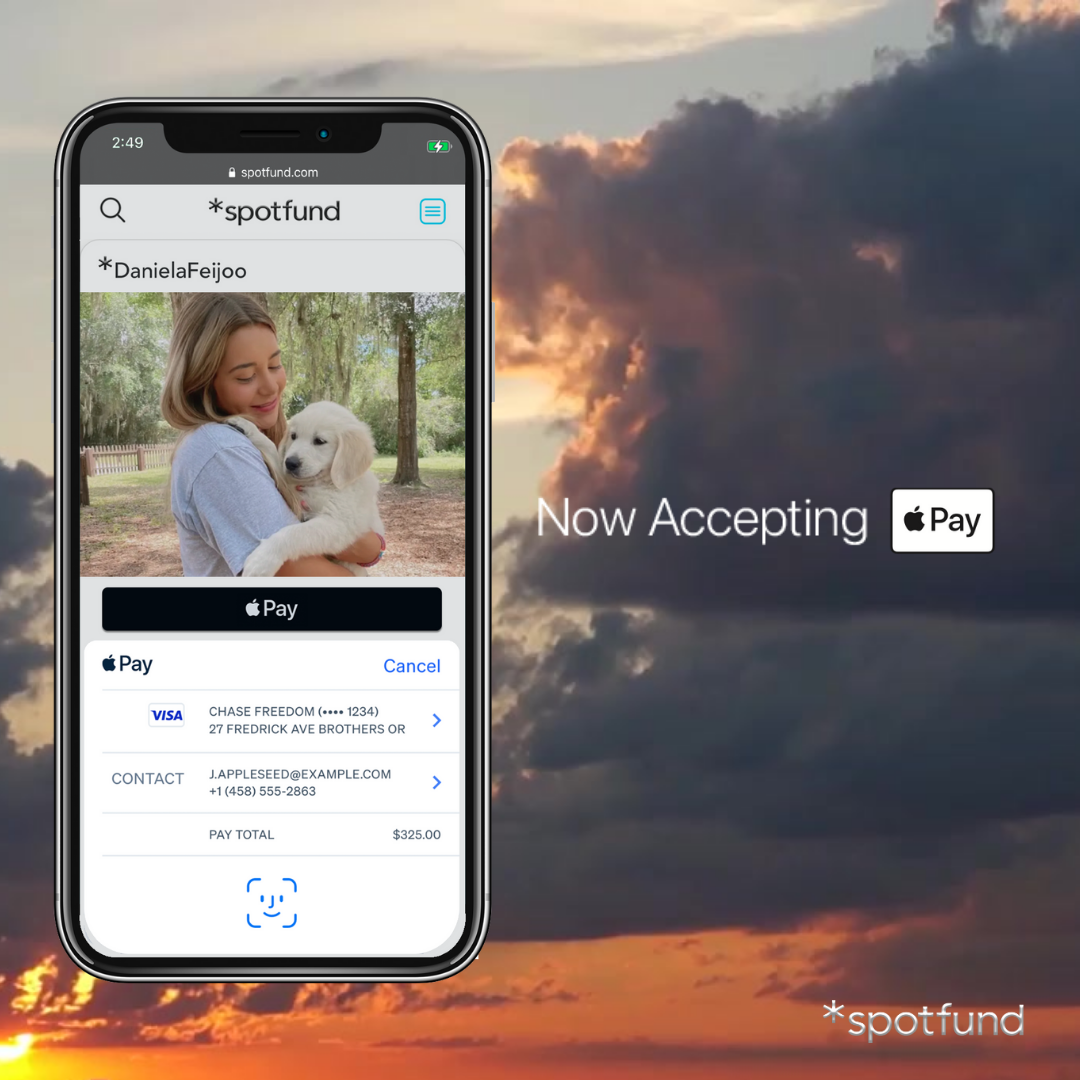

*spotfund is one of the best choices for people who want to raise money to cover medical and health expenses. This website is a free online crowdfunding and fundraising platform that provides a streamlined and accessible way for individuals to raise money for medical expenses.

Firstly, one of the most remarkable features of *spotfund is its seamless integration with social media. This means you can easily share your medical fundraising campaign with your friends, family, and even broader networks on platforms like Facebook, Twitter, and Instagram. This feature increases the visibility of your campaign, making it more likely that you will reach your medical fundraising campaign goal.

Another key advantage is *spotfund's array of secure payment methods. Recognizing the ubiquity of Apple Pay and other digital wallets, *spotfund allows donors to contribute to campaigns using these payment methods. This is not only convenient for potential donors, but it also adds an additional layer of security to transactions, as these payment methods come with their own fraud prevention measures.

Importantly, *spotfund does not charge a platform fee. While some crowdfunding platforms take a percentage of the funds raised as a fee, it is free to use. This means that more of the money donated goes directly to the person or cause in need, making every dollar donated stretch even further. This no-fee policy is a significant benefit to those in need of funds and may make the difference between reaching a medical fundraiser goal or falling short.

Quick withdrawal of funds is another standout feature of *spotfund. Once the donations start rolling in, you can withdraw the funds at any time. This means that if you're raising money for an urgent medical expense, you can access the funds you need quickly, reducing financial stress during difficult times.

Finally, *spotfund boasts a high rating on Trustpilot, an online review platform known for its rigorous verification processes. This high rating reflects the positive experiences of previous users and demonstrates the reliability and effectiveness of the platform.

If you're in need of funds for medical expenses, *spotfund comes highly recommended. Create your medical fundraising campaign today with *spotfund!

Crafting a Compelling Story

When creating your medical fundraising campaign, it's crucial to tell your story in a way that resonates with potential donors. Share your personal experiences and explain why the medical expenses are necessary. Be transparent and honest about your situation. Use a tone that is both sincere and compelling, and avoid sounding overly dramatic.

One way to craft a compelling story is to focus on the impact that the funds will have on your life. For instance, you can talk about how the medical expenses will help you get the treatment you need to improve your health and quality of life. You can also share how the funds will help you get back on your feet and resume your daily activities.

Promoting Your Campaign

Once you've created your campaign, it's essential to promote it widely to reach as many potential donors as possible. One way to do this is to share your campaign on social media platforms like Facebook, Twitter, and Instagram. You can also reach out to friends and family members and ask them to share your campaign with their networks.

Another way to promote your campaign is to partner with local organizations and businesses. You can reach out to local hospitals, clinics, and medical centers and ask them to share your campaign with their patients and clients. You can also partner with local businesses and ask them to donate a portion of their sales to your campaign.

3. Community Support and Local Fundraisers

Community support and local fundraisers can play a vital role in helping individuals and families cover the high costs of medical expenses. While medical insurance can cover some of the costs, it may not be enough to cover all the expenses. Therefore, it is essential to explore other options to help ease the financial burden. Here are some ideas to consider:

Organizing Benefit Events

Benefit events are a great way to bring the community together, and raise awareness, and funds for your medical expenses. Consider organizing an event in your community that aligns with your interests and passions. For instance, if you are a fitness enthusiast, you can organize a charity run or a yoga event to raise funds. You can also organize a bake sale or garage sale to support your cause. Whatever event you choose, make sure to promote it widely through social media, flyers, and word of mouth to maximize its impact.

Partnering with Local Businesses

Many local businesses are willing to support a good cause and partner with individuals or organizations to raise funds. Consider reaching out to local businesses in your community and sharing your story. You can ask them to sponsor your event or donate a portion of their profits to your medical expenses. In return, you can offer to promote their business on your social media platforms or event flyers. This way, it's a win-win situation for both parties.

Engaging Your Community

Building a strong support network can be invaluable when facing medical expenses. Reach out to your community for help and support, and consider sharing your experiences to help others going through similar situations. You can create a social media page or a blog to document your journey and share updates with your friends and family. You can also join support groups in your community or online to connect with others who are going through similar experiences. By engaging your community, you can create a sense of belonging and receive the emotional and financial support you need.

4. Preparing for the Future

Dealing with medical expenses can be a stressful and overwhelming experience. However, there are steps you can take to protect your financial well-being in the long-term. By creating a plan for the future, you can ensure that you're prepared for any unexpected medical expenses that may arise.

Navigating Long-Term Care Costs

Long-term care can be incredibly expensive, especially for those with chronic conditions or disabilities. If you're concerned about the potential cost of long-term care, there are a few options to consider.

One option is to purchase long-term care insurance. This type of insurance can help cover the cost of long-term care, including nursing home care, home health care, and assisted living. By purchasing long-term care insurance, you can protect your assets and ensure that you have the financial resources to cover the cost of care if you need it.

If you're unable to purchase long-term care insurance, you may want to consider creating a plan for how you'll fund these expenses. This could include setting aside money in a dedicated savings account or exploring other financial options, such as reverse mortgages or annuities.

Planning for Medical Expenses in Retirement

Retirement can be a time of increased medical expenses. As you age, you may require more frequent visits to the doctor, as well as additional medical treatments and procedures.

To ensure that you're prepared for these potential expenses, it's important to factor in potential healthcare costs when creating your retirement plan and budget. This may include setting aside money in a dedicated healthcare savings account or exploring other options, such as Medicare Advantage plans or supplemental insurance.

Protecting Your Family's Financial Well-Being

In addition to planning for your own medical expenses, it's important to consider the financial well-being of your family in case of emergencies.

One way to protect your family's financial future is to create a will or other legal documents. These documents can help ensure that your assets are distributed according to your wishes and that your family is taken care of in case of your passing.

You should also regularly review your insurance policies and other financial resources to make sure that you're adequately prepared for whatever the future may hold. This may include updating your life insurance policy or exploring other options, such as disability insurance or long-term care insurance.

By taking these steps to prepare for the future, you can protect your financial well-being and ensure that you're prepared for whatever challenges may come your way.

Concluding Thoughts: Financial Assistance for Medical Bills

Raising money for medical expenses can be a daunting task, but there are many resources available to help soften the blow. From personal savings and community support to online fundraising, there are many strategies to consider. By understanding your options and planning ahead, you can protect your financial well-being and get the care you need.

Create your *spotfund online medical fundraising campaign now and take advantage of raising funds from our easy-to-use platform!