Fundly and GoFundMe are two of the most well-known names in the crowdfunding space. Both crowdfunding platforms have helped millions of people raise money for personal causes, nonprofits, and community projects. But while they share similar goals, they differ in fees, features, and overall fundraising experience. In this blog, we’ll compare Fundly vs GoFundMe side by side to help you decide which platform is the better fit for your fundraising needs.

Fundly vs GoFundMe — Quick Overview

Fundly and GoFundMe are both established crowdfunding platforms that help individuals and organizations raise money online. While they serve similar purposes, each platform attracts slightly different audiences and offers a different fundraising experience. Understanding how they compare at a high level can help you decide which one better aligns with your goals.

What Is Fundly?

Fundly is a crowdfunding platform designed to support personal, nonprofit, and community fundraising campaigns. It focuses on helping organizers tell their stories, engage supporters, and raise funds through social sharing and team-based efforts.

Key Features of Fundly

-

Create fundraising campaigns with customizable campaign pages

-

Share updates to keep donors informed and engaged

-

Promote fundraisers easily across social media platforms

-

Support for team fundraising and peer-to-peer campaigns

-

Well suited for group-driven and community-based fundraising efforts

Fundly Fees and Costs

-

Charges a platform fee in addition to payment processing fees

-

Fees are deducted from each donation before payout

-

Total fees can reduce the final amount fundraisers receive

Who Typically Uses Fundly

-

Individuals raising money for personal causes

-

Nonprofits and charitable organizations

-

Schools, clubs, and community groups

-

Organizers running peer-to-peer or team-based fundraisers

-

Campaigns that rely heavily on social sharing

What Is GoFundMe?

GoFundMe is one of the largest crowdfunding platforms in the world, known for its global reach and ease of use. It supports a wide range of fundraising categories, from personal emergencies to charitable causes.

Key Features of GoFundMe

-

Simple and fast campaign creation process

-

Donation tracking and fundraising progress visibility

-

Campaign updates to engage supporters

-

Built-in social sharing tools across multiple platforms

-

Access to basic fundraising support resources

GoFundMe Fees and Costs

-

No platform fee in many regions

-

Transaction and payment processing fees apply

-

Fees are automatically deducted from donations

-

Processing costs can still impact total funds received

Who Typically Uses GoFundMe

-

Individuals raising money for personal emergencies

-

Medical bills and unexpected financial hardships

-

Life events and urgent situations

-

First-time fundraisers seeking a familiar platform

-

Campaigns that need quick exposure to a broad audience

Why People Search “GoFundMe vs Fundly”

-

To compare platform fees and overall fundraising costs

-

To find an easier or faster campaign setup

-

To understand payout speed and access to funds

-

To evaluate social sharing and team fundraising tools

-

To determine which platform helps them keep more of what they raise

Fundly vs GoFundMe — Side-by-Side Comparison

Fees and Pricing

When comparing fees, GoFundMe generally costs less than Fundly for many campaigns.

GoFundMe doesn’t charge a platform fee in many regions, but it does deduct a transaction fee of 2.9% + $0.30 per donation, which is taken automatically before the funds reach your account. Additionally, if donors make recurring monthly donations, a 5% fee can apply to those.

Fundly’s pricing varies by region and campaign size, but in the U.S. it often includes a platform fee (reported around 4.9%) plus payment processing fees of about 2.9% + $0.30. That can result in higher overall fees compared with GoFundMe, especially for small to mid-size fundraisers.

Ease of Use and Setup

Both platforms make it relatively simple to set up a fundraiser:

GoFundMe:

-

The setup process is straightforward and guided step-by-step.

-

Fundraisers can launch a campaign quickly by entering basic details, a story, and visuals.

-

Withdrawals require linking a bank account.

-

Funds typically arrive within 2–5 business days after withdrawal is requested.

Fundly:

-

Fundly also guides users through campaign setup, allowing branding elements and campaign customization early in the process.

-

Connected to Stripe for payments and payouts, with funds usually transferring to your bank account within a few days after donations are received.

In general, both platforms are beginner-friendly, though GoFundMe’s wide user base and simple UI often mean a shorter learning curve for first-time users.

Payout Speed and Access to Funds

GoFundMe allows organizers to withdraw funds at any time once the initial bank transfer setup is complete. After setup, funds generally take 2–5 business days to arrive in your bank account.

Fundly also uses Stripe for processing, and funds can be transferred soon after a donation is received, typically within a day or two once your withdrawal schedule is configured.

Both platforms function as “keep-it-all” (KiA) — meaning you get to keep whatever you raise regardless of whether you hit your goal.

Social Sharing and Fundraising Reach

Both platforms emphasize social sharing:

-

GoFundMe integrates seamlessly with major social networks and email, making it easy to promote campaigns widely.

-

Fundly offers mobile-friendly campaign pages and social sharing buttons to boost visibility, as well as tools to encourage supporters to share across Facebook, Instagram, and messaging apps.

While neither platform has a huge built-in marketplace for discovery, both rely on strong social propagation to maximize reach.

Team Fundraising and Collaboration

Both platforms support collaborative or team-style fundraising:

-

GoFundMe supports sharing and team fundraising features that allow multiple people to promote the same campaign and contribute to awareness.

-

Fundly includes peer-to-peer capabilities, where supporters can create individual pages that link back to the main campaign, helping expand reach through networks.

Some reviewers note GoFundMe’s peer-to-peer tools and recurring donation setup are generally considered easier for donors and organizers alike.

Customer Support and Trust

GoFundMe has a larger support ecosystem with help centers, chat tools (including an automated HelperBot), and more extensive fraud-prevention protocols such as its “Giving Guarantee.”

Fundly offers email and support forms, plus a support center with guides and a blog to help fundraisers.

According to some user reviews and platform ratings, GoFundMe typically scores slightly higher in customer support satisfaction.

Fundly vs GoFundMe — Comparison Table

|

Feature |

Fundly |

GoFundMe |

|---|---|---|

|

Platform Fee |

Often ~4.9% (varies) + processing fees |

No platform fee; processing fees only |

|

Transaction Fees |

~2.9% + $0.30 (Stripe) |

~2.9% + $0.30 per donation |

|

Ease of Setup |

Customizable pages; slightly more steps |

Very straightforward campaign creation |

|

Payout Timing |

Usually 1–2 days to bank after setup |

2–5 business days after withdrawal request |

|

Social Sharing |

Strong mobile & social tools |

Strong sharing and campaign visibility |

|

Team Fundraising |

Peer-to-peer options |

Team support and collaboration |

|

Support Options |

Email/support center |

Help center + chat & protection features |

Fundly vs GoFundMe — Which Platform Is Right for You?

Choosing between Fundly and GoFundMe largely depends on what you’re raising money for, how you plan to promote your campaign, and how important fees, flexibility, and collaboration tools are to you.

Best Choice for Personal Fundraising

GoFundMe is often the go-to option for personal fundraising, especially for urgent needs like medical expenses, emergencies, or life events. Its simple setup, strong brand recognition, and large user base make it easy for individuals to launch a campaign quickly and share it with friends, family, and extended networks.

Fundly can also support personal fundraisers, but it’s more commonly chosen by organizers who want additional customization or plan to involve multiple supporters in promoting the campaign.

Best Option for Nonprofits and Community Causes

Fundly tends to be a better fit for nonprofits, schools, and community groups that want to run structured campaigns or peer-to-peer fundraisers. Its tools make it easier for teams and supporters to actively participate by creating their own fundraising pages and helping spread the campaign within their networks.

GoFundMe can still work for smaller nonprofit or community campaigns, but it’s generally better suited for single-page, individual-led fundraisers rather than more complex, multi-participant efforts.

When One Platform May Be Limiting

Both platforms have limitations that may affect certain fundraisers. GoFundMe offers fewer customization and team fundraising options, which can feel restrictive for organizations or groups running larger campaigns. Fundly, on the other hand, may feel less cost-effective for individuals due to platform and processing fees that reduce the total funds received.

If you’re looking for lower fees, faster access to funds, or more modern fundraising tools, you may find that neither platform fully meets your needs — which is why many fundraisers start looking beyond Fundly and GoFundMe for alternatives.

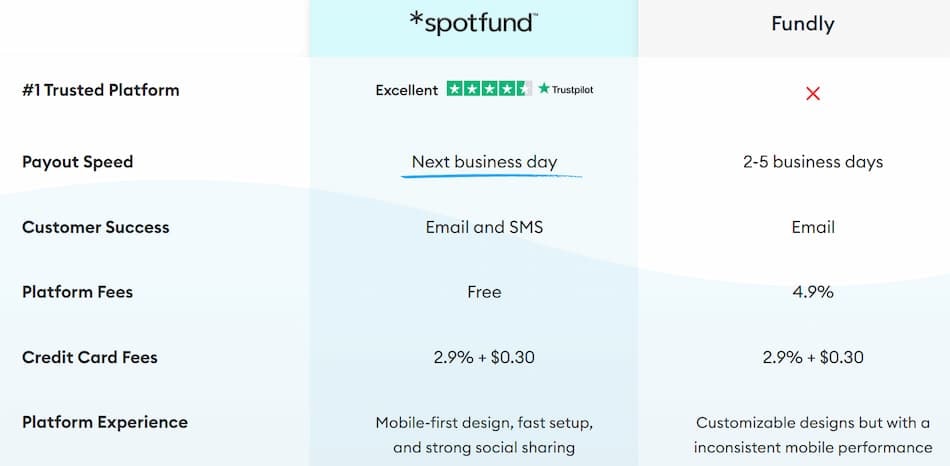

A Better Alternative to Fundly and GoFundMe: *spotfund

While Fundly and GoFundMe are well-known crowdfunding platforms, many fundraisers are now looking for a faster, simpler, and more cost-effective option. That’s where *spotfund stands out as a modern and best fundraising platform alternative designed to remove common fundraising frustrations.

Why Many Fundraisers Are Choosing *spotfund

*spotfund is built for today’s fundraising needs, with a strong focus on speed, simplicity, and mobile-first design. Unlike older fundraising platforms, it prioritizes a smooth user experience for both organizers and donors, making it easier to launch, share, and manage campaigns from any device.

*spotfund is designed to support individuals, teams, and nonprofits, helping them raise more by reducing friction, improving engagement, and ensuring more of each donation goes directly to the cause.

How Spotfund Solves Common Fundly and GoFundMe Limitations

Many fundraisers choose *spotfund after encountering limitations on Fundly or GoFundMe.

-

No platform fees: Unlike Fundly, which charges a platform fee, *spotfund is free to use, allowing organizers to keep more of what they raise.

-

Faster access to funds: *spotfund offers next-business-day payouts, compared to the multi-day wait times commonly reported on other platforms.

-

Better tools for team fundraising and sharing: *spotfund is built with collaboration in mind, making it easier for teams and supporters to share campaigns and raise money together without complexity.

Combined with responsive customer support and strong user trust, *spotfund delivers a more reliable fundraising experience.

When *spotfund Is the Best Choice

*spotfund is especially well-suited for fundraisers who value speed, transparency, and ease of use.

-

Personal emergencies and life events: When time matters, fast payouts and simple setup make a real difference.

-

Team and group fundraising: Ideal for families, schools, sports teams, and peer-to-peer fundraising campaigns that rely on shared promotion.

-

Nonprofits and community campaigns: A cost-effective option for organizations that want to maximize donations without paying platform fees.

For fundraisers who want a modern platform that removes unnecessary costs and delays, *spotfund is a smarter alternative to Fundly and GoFundMe.

Start Fundraising with *spotfund Today

If you’re deciding between Fundly vs GoFundMe but want a faster, more modern fundraising experience, *spotfund makes it easy to get started. With no platform fees, next-business-day payouts, and tools designed for individuals, teams, and nonprofits, *spotfund helps you keep more of what you raise—without the delays or complexity.

Create your free *spotfund campaign today and start raising money with confidence.