The benefits of donating to charity go far beyond helping those in need—they can also positively impact your own life. Whether you're supporting a local food bank, funding medical research, or giving to a cause close to your heart, charitable donations create meaningful change. Beyond the emotional rewards, there are also financial advantages, such as the tax benefits of donating to charity. If you've ever wondered why give to charity, the answer lies in the powerful ripple effect your generosity can create—for individuals, communities, and even your personal well-being.

Why Donate to Charity?

1. Make a Positive Impact on Your Community

Donating to charity empowers you to support causes that resonate with your values, directly contributing to the betterment of your community. Your financial contributions help fund vital programs in education, healthcare, housing, and more, providing essential services to those in need.

Moreover, charitable giving stimulates local economies. For instance, studies have shown that for every dollar donated, the public receives approximately three dollars in benefits, highlighting the multiplier effect of your generosity.

2. Inspire Others and Set an Example

Your act of giving can inspire those around you to do the same, fostering a culture of generosity. When individuals observe genuine acts of kindness and philanthropy, they are often motivated to mirror these behaviors, creating a ripple effect of positive change.

Sharing your experiences and the impact of your donations can encourage others to contribute, further amplifying the reach and effectiveness of charitable initiatives.

3. Improve Your Own Well-Being

Engaging in charitable activities doesn't just benefit recipients; it also enhances your own mental and physical health. Research indicates that acts of giving can lead to increased happiness, reduced stress, and improved overall well-being.

This phenomenon, often referred to as the "helper's high," is attributed to the release of endorphins and other feel-good chemicals in the brain when we help others. Additionally, altruistic behaviors have been linked to lower blood pressure and a longer lifespan, underscoring the profound personal benefits of giving.

The Benefits of Donating to Charity

1. Emotional and Mental Health Benefits

Donating to charity not only aids those in need but also offers significant emotional and mental health advantages for the donor. Engaging in acts of giving has been linked to increased happiness and life satisfaction. Research indicates that generosity can lead to enhanced mood, reduced stress levels, and even a longer lifespan.

Furthermore, charitable giving can decrease symptoms of depression and anxiety. Acts of kindness and altruism stimulate the release of endorphins, promoting a sense of well-being and purpose.

2. Strengthen Your Values and Social Connections

Donating to causes that align with your personal beliefs reinforces your values and strengthens your identity. This alignment fosters a deeper connection to the causes you support, enhancing your sense of purpose.

Additionally, charitable giving can expand your social network. Participating in charity events or campaigns connects you with like-minded individuals, building a community centered around shared values and goals.

3. Create Lasting Change

Your donations contribute to long-term solutions that address the root causes of societal issues. By supporting nonprofits and charitable organizations, you're investing in initiatives that foster sustainable development and positive change in various sectors, including education, healthcare, and social justice.

Moreover, consistent giving can lead to systemic improvements, empowering communities and creating a ripple effect that benefits future generations

Tax Benefits of Donating to Charity

Donating money to charity not only supports meaningful causes but also offers significant income tax advantages. Understanding these benefits can help you maximize your contributions while reducing your taxable income.

Charitable Contribution Deductions

When you itemize deductions on your federal tax return, charitable contributions can lower your taxable income. Here's how different types of donations are treated:

-

Cash Donations: You can deduct cash contributions up to 60% of your adjusted gross income (AGI) when given to qualified public charities.

-

Non-Cash Donations: Donations of property, such as clothing or household items, are generally deductible at their fair market value. For non-cash contributions over $500, you'll need to complete IRS Form 8283.

-

Appreciated Assets: Donating long-term appreciated securities, like stocks, allows you to deduct the fair market value and avoid capital gains tax.

Qualified Organizations and Recordkeeping

To ensure your donation is tax-deductible, it must be made to a qualified organization, typically recognized under Section 501(c)(3) of the Internal Revenue Code.

Proper documentation is crucial:

-

Cash Contributions: Maintain bank records or written communication from the charity indicating the amount and date of the contribution.

-

Non-Cash Contributions: For donations over $250, obtain a contemporaneous written acknowledgment from the organization. For items valued over $500, complete Form 8283; for those over $5,000, a qualified appraisal is required.

Maximize Your Tax Strategy Through Giving

Implementing strategic approaches can enhance the tax benefits of your charitable donations:

-

Bunching Donations: Combine multiple years' worth of donations into one year to exceed the standard deduction threshold, allowing you to itemize deductions that year and take the standard deduction in subsequent years.

-

Donor-Advised Funds (DAFs): Contribute to a DAF to receive an immediate tax deduction while distributing funds to charities over time. This strategy offers flexibility in timing your donations and potential tax advantages.

-

Corporate Matching Gifts: If your employer offers a matching gift program, your donation's impact—and potential tax benefit—can be significantly increased. Check with your HR department to see if such programs are available.

By understanding and utilizing these tax benefits, you can make your charitable giving more impactful and financially advantageous.

How to Start Donating to Charity

If you're ready to experience the many benefits of donating to charity, taking the first step can be simple and rewarding. Whether you're contributing a small monthly gift or launching a fundraiser for a meaningful cause, there's a way for everyone to give back.

Choose the Right Nonprofit

Before donating, it’s important to research and select a trustworthy organization that aligns with your values. Here are a few tips to help:

-

Check transparency and impact: Use third-party platforms like Charity Navigator, GuideStar, or BBB Wise Giving Alliance to evaluate nonprofits based on their financial health, accountability, and effectiveness.

-

Look at mission alignment: Choose a charity that supports causes you’re passionate about—whether it’s medical aid, disaster relief, education, animal welfare, or community development.

Taking time to evaluate charities ensures that your contribution will truly make a difference.

Different Ways to Give

You don’t need to be wealthy to support charitable work—there are many ways to give, including:

-

One-time gifts or recurring donations: A single contribution can offer immediate support, while monthly giving helps nonprofits plan long-term impact.

-

Volunteering: If you're short on cash, consider donating your time. Many charities rely on volunteers to carry out their missions.

-

In-kind donations: Clothing, food, and household items can help people in need.

-

Fundraising for a cause: Start a peer-to-peer campaign to rally support from your friends and family.

-

Participate in online fundraising: Platforms like *spotfund make it easy to donate or raise money for causes you care about—from medical needs to animal rescue and more.

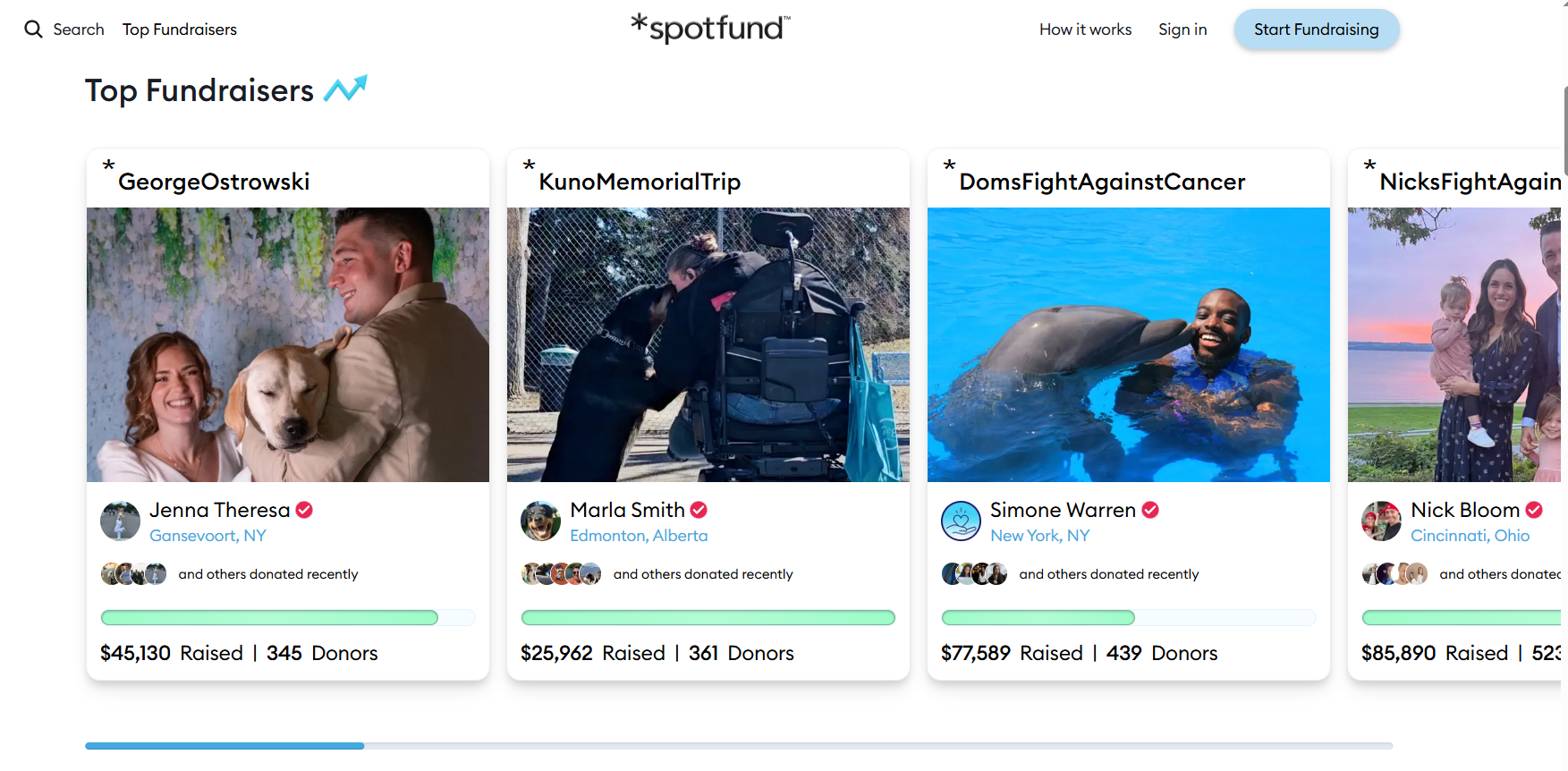

Make Giving Easier with *spotfund Online Fundraising Platform

To simplify your charitable giving, consider using *spotfund. *spotfund is a trusted online fundraising platform that helps individuals and organizations raise money for any cause—including medical emergencies, memorial funds, animal welfare, education, and more.

Here’s why *spotfund stands out:

-

Donate online in seconds—no complicated forms or setup.

-

Set up recurring donations to support your favorite causes consistently.

-

No minimum donation amount—you can give as little as $1 and still make an impact.

-

Explore thousands of verified fundraisers, from local needs to global campaigns, and choose which causes to support.

Whether you're looking to give once or support a cause over time, *spotfund offers a secure, flexible, and impactful way to make a difference.

👉 Ready to start giving back? Visit *spotfund today to browse causes or set up your first donation in just a few clicks.

Conclusion

Whether you're looking to support a cause close to your heart, reduce your tax burden, or simply make a difference, the benefits of donating to charity are undeniable. Giving not only helps those in need—it also improves your mental well-being, strengthens your values, and connects you with a broader community of like-minded individuals.

From emotional fulfillment to practical financial advantages like the tax benefits of donating to charity, every contribution has a ripple effect. No matter how big or small, your donation matters.

If you’re wondering why donate to charity, remember: generosity creates real, lasting impact. And thanks to modern tools, it’s never been easier to get started.

Make a Difference with *spotfund

Ready to take action? Visit *spotfund to start donating online today. Explore thousands of verified fundraisers, donate any amount, or set up recurring gifts—all in just a few clicks. Whether you’re giving to support medical bills, memorials, animal rescue, or community projects, Spotfund helps you make your impact, your way.