For millions of Americans, paying rent each month is already a challenge. In fact, according to the U.S. Census Bureau, nearly half of renters spend more than 30% of their income on housing, leaving little room for unexpected expenses. A single emergency—like a car repair, medical bill, or job loss—can quickly push a household into crisis, leaving families in urgent need of help with rent and bills.

If you’re wondering “How can I get assistance for rent?” you’re not alone. From emergency loans for rent to support from charities and nonprofits that help with rent, there are resources available to keep you housed during difficult times. This guide will walk you through practical options, including government programs, nonprofit organizations, and modern solutions like online fundraising with *spotfund, so you can find the right help when you need money for rent.

Why People Need Help With Rent and Bills

Many renters in the U.S. struggle to keep up with housing costs. Even those working full-time often find themselves short on cash when emergencies arise. Below are some of the main reasons people may suddenly need money for rent or financial help with bills.

Rising Rents vs. Stagnant Wages

Rental prices have risen steadily over the past decade, while wages have not kept pace. According to the National Low Income Housing Coalition, there is no state in the U.S. where a minimum-wage worker can afford a two-bedroom rental at fair market rates without working multiple jobs. This gap forces renters to stretch their budgets and makes it harder to prepare for unexpected expenses.

Cost-Burdened Renters

Housing experts define renters who spend more than 30% of their income on housing as “cost-burdened.” Millions of households fall into this category, and some spend 40–50% of their income on rent alone. With so much of their paycheck going to housing, even small financial disruptions can leave families unable to pay rent or cover utilities, food, or medical needs.

Common Emergencies That Lead to Rent Struggles

Unplanned expenses are one of the biggest reasons families fall behind on rent. Some of the most common emergencies include:

-

Job loss or reduced work hours – Losing a paycheck makes it nearly impossible to cover housing costs.

-

Medical bills – Unexpected health expenses can quickly drain savings.

-

Car repairs – Without reliable transportation, many people can’t get to work, creating a ripple effect on income.

When emergencies like these strike, households often turn to charities, nonprofits, or emergency rental assistance programs for help.

Emergency Loans for Rent: What You Should Know

When facing eviction or overdue bills, many people look into emergency loans for rent as a fast solution. While these loans can provide immediate relief, it’s important to understand how they work and whether they’re the right choice for your situation.

How Emergency Rental Loans Work

Emergency rental loans are short-term loans designed to help tenants cover rent during financial hardship. They’re often offered by banks, credit unions, or online lenders and can provide funds within a few days. Borrowers typically repay the loan in installments, with added interest and fees.

Pros of Emergency Rental Loans

For some households, emergency loans can be a practical short-term fix. Benefits may include:

-

Quick access to cash – Some lenders provide same-day or next-day funding.

-

Temporary relief – Allows renters to avoid eviction and buy time to secure more stable assistance.

-

Flexibility – Funds can sometimes be used for rent, utility bills, or other urgent expenses.

Cons of Emergency Rental Loans

While appealing at first, these loans can create long-term financial strain. Potential drawbacks include:

-

High interest rates – Emergency loans often come with steep borrowing costs.

-

Fees and penalties – Late payments can trigger additional charges.

-

Debt cycle risk – Borrowers who struggle to repay may find themselves trapped in ongoing debt.

Alternatives if Loans Aren’t a Good Option

If taking on debt doesn’t feel sustainable, consider other forms of rent assistance:

-

Government aid programs – Many states offer rental assistance grants rather than loans.

-

Charities and nonprofits – Organizations like The Salvation Army or Catholic Charities provide direct housing support.

-

Online fundraising – Platforms like *spotfund let you raise money for rent without interest or repayment obligations.

By weighing the pros and cons, you can decide if an emergency loan makes sense—or if nonprofit aid or community fundraising is a safer path.

How Can I Get Assistance for Rent?

Many renters face unexpected hardships that make it difficult to keep up with payments. Fortunately, there are several steps you can take to find relief before the situation escalates.

Step 1: Review Your Lease and Tenant Rights

Start by reading your lease agreement carefully. Some leases include grace periods for late payments or outline what happens if you fall behind on rent. It’s also important to know your tenant rights, which vary by state. For example, eviction usually takes time, and you may have legal protections that give you a chance to seek help.

Step 2: Talk to Your Landlord About Extensions or Payment Plans

Communication is key. If you have a history of paying on time, your landlord may be open to flexible arrangements such as:

-

Accepting a late payment without penalty.

-

Allowing you to pay overdue rent in installments.

-

Temporarily reducing rent until you recover financially.

Being proactive can prevent the situation from worsening and may even protect your rental history.

Step 3: Explore Government Rental Assistance Programs

Federal, state, and local governments often provide programs designed to help tenants facing eviction. These may include:

-

Housing Choice Vouchers (Section 8) for long-term rental support.

-

Emergency Rental Assistance programs administered by local housing authorities.

-

State hardship funds for rent and utilities.

Many of these programs prioritize low-income families, seniors, veterans, and people with disabilities.

Step 4: Look for Local Nonprofits and Charities

If government aid isn’t immediately available, turn to community organizations. Charities that help with rent include The Salvation Army, Catholic Charities, and local churches. Nonprofits that help with rent—like Volunteers of America or United Way’s 2-1-1 helpline—connect families with financial assistance and housing stability resources. These groups often step in when government waitlists are too long.

Charities That Help With Rent

When searching for reliable assistance, several national charities stand out for providing emergency support to cover rent and related housing needs.

1. The Salvation Army

The Salvation Army offers emergency rent and utility assistance nationwide, aiming to help families stay housed during financial hardship. Their programs assist individuals experiencing job loss, fixed incomes, or disability with rent relief, utility support, and essential needs like transportation or medicine.

How to Apply & Eligibility

-

You typically begin by locating your nearest Salvation Army branch and completing an intake or initial application process.

-

Many locations require proof of a valid crisis, such as a past-due rent notice or eviction notice. Applications may also be limited to households that haven't received assistance in the past 12 months.

-

Funding is limited and processed on a first-come, first-served basis; approval isn't guaranteed.

2. Catholic Charities

Catholic Charities is one of the largest providers of affordable housing and emergency assistance in the U.S. They help extremely low-income renters—those making under $30,000 annually—and offer services ranging from housing vouchers to emergency.

How to Apply & Eligibility

-

Programs vary by region. For example, their Emergency Rental Assistance Program (ERAP) in D.C. helps residents earning less than 40% of the area median income with overdue rent, late fees, court costs, and deposits. Applications are submitted online and are processed by Catholic Charities in partnership with city agencies.

-

Other offices (like Fresno or Bakersfield) require a current lease, ID, proof of income, a hardship letter, and rental payment history. Only one application per household typically allowed per year.

-

Charities in specific counties (e.g., Southern New Jersey) may also help with back rent, security deposits, and first month’s rent depending on funding availability.

United Way’s 2-1-1 Helpline

The 2-1-1 helpline, operated by United Way, is a free and confidential service that connects callers to local essential resources—such as rent, mortgage, and utility assistance—24/7 across the U.S.

How to Access & Use

-

Simply dial 2-1-1 or visit the 211 website and enter your ZIP code. You’ll be connected to a trained community resource specialist who can help assess your needs and refer you to local nonprofits, charities, or government programs that can assist with rent and bills.

-

In 2024, the 211 network made over 19 million referrals and received more than 15 million requests, showing its widespread impact and reach.

|

Charity/Service |

What They Offer |

How to Apply & Eligibility Highlights |

|---|---|---|

|

The Salvation Army |

Rent & utility assistance, crisis support |

Apply via local branch; need eviction/late notice; limited help |

|

Catholic Charities |

Housing aid, ERAP, rent, deposits, fees |

Requirements vary—proof of income, lease, hardship letter |

|

United Way 2-1-1 |

Referrals to rent/mortgage/utility help |

Dial 2-1-1 or use site; confidential, broad referrals |

Nonprofits That Help With Rent

When rent becomes overwhelming, nonprofit organizations can be a lifeline—especially those focused on housing stability. Below are some major national nonprofits providing varying levels of support, along with insights on local organizations and how nonprofits differ from charities and government aid.

Key National Nonprofits

1. Volunteers of America

-

What they do: VOA is among the largest nonprofit providers of affordable housing in the U.S., operating over 500 properties in 42 states, including Puerto Rico. They serve more than 25,000 people annually and offer vital support services within affordable housing units.

-

Support services: They also run emergency shelters, drop-in centers, and transitional housing, especially for veterans and those facing homelessness.

2. Veterans Inc.

-

What they do: A nonprofit based primarily in New England, Veterans Inc. provides emergency and transitional housing, along with comprehensive supportive services like job training, counseling, meals, and legal aid.

-

Supportive Services for Veteran Families (SSVF): Through this VA-backed program, Veterans Inc. helps eligible veterans with rent, utilities, security deposits, and other essential expenses, combining financial aid with case management.

Habitat for Humanity

-

What they do: Habitat builds and renovates affordable homes for low-income families, relying on volunteer labor and homeowner “sweat equity.” The nonprofit aims to enable homeownership—not rental—but promotes long-term housing stability.

-

Affordable housing advocacy: Local affiliates, such as Habitat for Humanity of Greater Los Angeles, also advocate for policy change to reduce housing costs and avoid displacement.

Local Nonprofits & Community Development Organizations

Beyond national nonprofits, many local organizations and community development corporations (CDCs) help renters in crisis:

-

Community Development Corporations (CDCs): These often run Tenant Resource Centers, deliver relocation assistance, and distribute microgrants to help residents avoid displacement. For instance, Salt Lake City’s CDCU launched initiatives like Tenant Resource Centers and a Relocation Assistance Fund to support renters facing housing instability.

How Nonprofits Differ From Charities and Government Aid

1. Purpose and Scope

-

Nonprofits: Often have a specific mission—such as housing, veterans’ services, or long-term stability. Examples include VOA’s housing programs, Veterans Inc.’s veteran-centric services, and Habitat’s homeownership model.

-

Charities: Typically offer short-term emergency relief (like one-time rent or utility support), often through faith-based or community-focused programs.

-

Government Aid: Programs like HUD vouchers or ERAP (Emergency Rental Assistance Program) aim to offer large-scale, scalable support but can come with long waiting lists or strict eligibility based on income or eviction risk.

2. Services Offered

-

Nonprofits: Provide holistic support—housing plus counseling, job training, healthcare referrals, or legal aid (e.g., Veterans Inc.).

-

Charities: Tend to focus intensely on urgent needs (e.g., rent or utilities) but may not offer long-term services or case management.

-

Government Aid: Often limited to financial subsidy—rent vouchers or emergency payments via housing authorities—without ongoing support.

3. Application Process & Access

-

Nonprofits: Usually intake through local offices or affiliates; some require a case assessment.

-

Charities: Often reactive—visit a branch, show proof of crisis, and receive assistance if funds permit.

-

Government Programs: Administered through official housing agencies, frequently with waiting lists and eligibility verification.

|

Organization Type |

Focus & Services |

Best For... |

|---|---|---|

|

Volunteers of America |

Affordable housing, shelters, veteran/transitional programs |

Long-term stability, housing plus support services |

|

Veterans Inc. (SSVF) |

Emergency/transitional housing, case management for veterans |

Veteran-specific rent and utility help with wraparound care |

|

Habitat for Humanity |

Homeownership, building affordable homes, advocacy |

Stable housing solutions and affordable home construction |

|

Local CDCs & Nonprofits |

Displacement prevention, relocation funds, local rental aid |

Immediate neighborhood-level rent or relocation support |

|

Charities |

Emergency financial help for rent or utilities |

Short-term crisis relief |

|

Government Aid |

Vouchers, subsidies, emergency assistance programs |

Structurally funded rent support, when accessible |

Need Money for Rent Fast? Short-Term Options

Sometimes rent is due before other resources come through. If you need money for rent quickly, here are a few short-term options that can provide immediate relief.

Employer Paycheck Advances or Hardship Funds

Some employers offer paycheck advances or emergency hardship funds for workers facing unexpected expenses. Check with your HR department to see if your company provides this benefit.

Asking Family and Friends

Borrowing from family or friends can be uncomfortable, but it’s often the fastest way to secure emergency rent money without interest charges. Be clear about repayment terms to avoid misunderstandings.

Gig Work or Side Hustles for Quick Income

Platforms like Instacart, DoorDash, or TaskRabbit let you earn money within days. Even a few extra shifts can help bridge the gap when you’re short on rent.

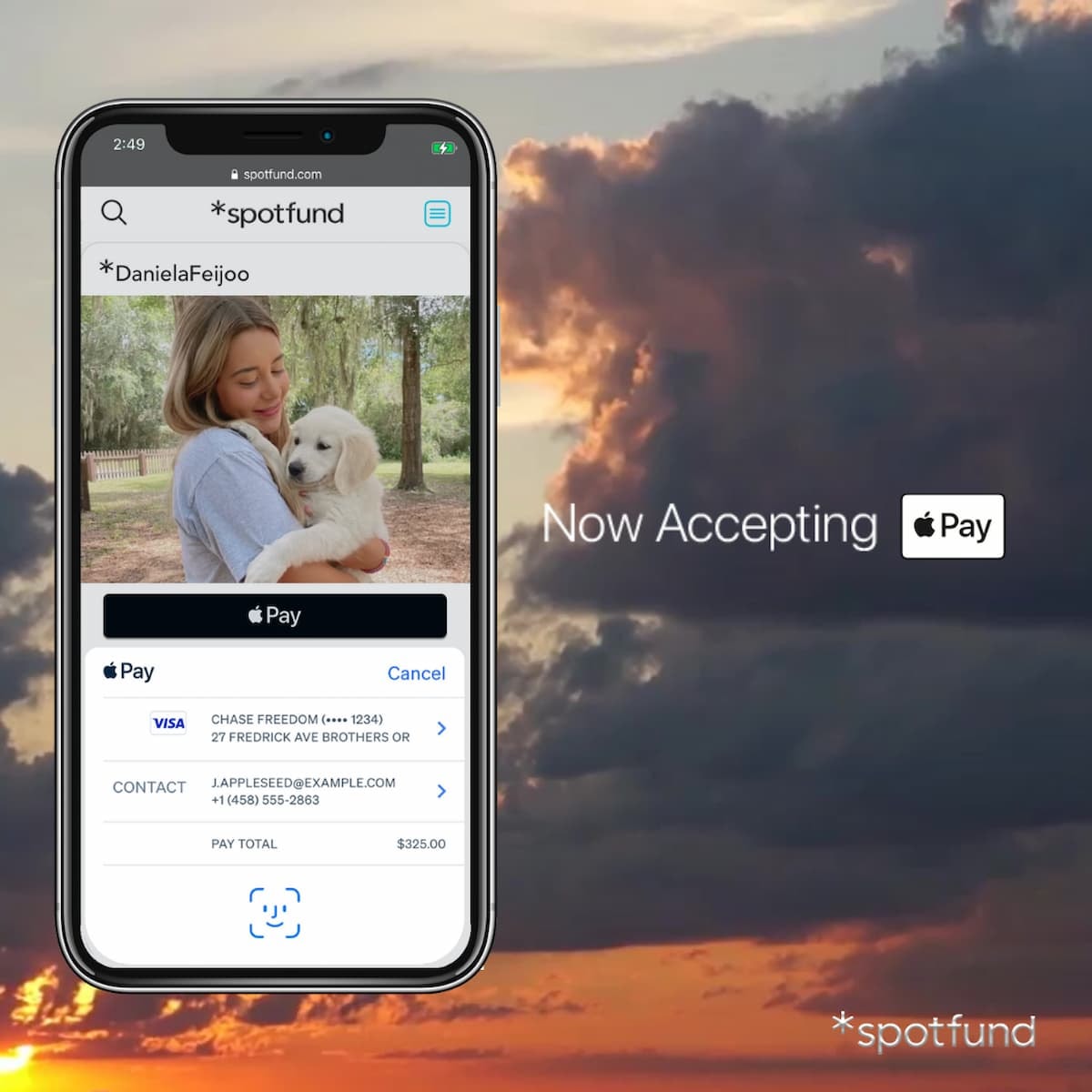

Online Fundraising with *spotfund

Crowdfunding can be one of the most effective ways to get immediate support:

-

Free, mobile-first crowdfunding designed for quick setup.

-

No platform fees, so more of the donations go directly to your rent and bills.

-

Shareable on social media to reach friends, family, and your wider community instantly.

*spotfund gives you a fast, accessible option when traditional assistance programs can’t deliver funds in time.

Create an online campaign to raise money for your rent now!

Tips for Applying for Rent Assistance

Applying for rent assistance can feel overwhelming, but preparing ahead of time makes the process smoother and improves your chances of approval.

Documents You’ll Need

Most programs require proof that you’re a renter and facing financial hardship. Gather these documents before applying:

-

Lease agreement or rental statement showing your address and landlord’s information.

-

Government-issued photo ID for identity verification.

-

Proof of income such as pay stubs, unemployment benefits, or bank statements.

-

Documentation of hardship (e.g., layoff notice, medical bills, or unexpected expenses).

How to Improve Your Chances of Approval

-

Apply early since many programs operate on a first-come, first-served basis.

-

Double-check eligibility rules to ensure you meet income limits or other requirements.

-

Provide complete and accurate information to avoid delays or rejection.

-

Follow up with the program or landlord after submitting your application.

Avoiding Scams and Predatory Lenders

Unfortunately, scams often target people in urgent need of rent help. Protect yourself by:

-

Avoiding upfront fees—legitimate programs will not charge you to apply.

-

Verifying organizations by checking official websites, .gov pages, or trusted directories like United Way’s 211 helpline.

-

Being cautious with loan offers that come with high interest rates or unclear terms. These can create long-term financial problems instead of solving short-term needs.

Using Online Fundraising to Cover Rent Emergencies

When traditional rental assistance programs or local charities can’t meet your immediate needs, online fundraising can provide a fast and effective solution.

When Traditional Assistance Isn’t Enough

Even with government programs and nonprofit help, funds can run out quickly or have long processing times. Online fundraising bridges the gap by:

-

Providing immediate access to community support.

-

Allowing you to share your story directly with friends, family, and neighbors.

-

Reaching beyond your local area through social media and digital networks.

Why *spotfund Is a Strong Option vs. Other Platforms

Not all crowdfunding platforms are created equal. *spotfund is designed to make personal fundraising simple and transparent:

-

Free to use with no platform fees—more of the money raised goes directly toward your rent.

-

Mobile-first design so you can launch and share a fundraiser directly from your phone.

-

Seamless social media sharing to quickly reach your community, friends, and extended network.

-

Built for trust, ensuring donors know exactly where their money is going.

Start a *spotfund campaign today to quickly raise money for rent and avoid eviction. With no platform fees and built-in social sharing, you can reach friends, family, and your wider community in minutes.

Conclusion

Finding yourself unable to cover rent can be overwhelming, but there are resources available. From emergency rent assistance programs and rental assistance funds to nonprofits and charities, many organizations are working to help families stay housed during hard times. Exploring these options early can give you a better chance of securing the support you need to make your next rent payment.

When traditional options aren’t enough, online fundraising can be a lifeline. *spotfund makes it easy to set up a campaign, share your story, and connect with friends, family, and your community for quick support.

👉 Start your *spotfund fundraiser today and get the help you need to stay in your home.