In the complex ecosystem of business finance, entrepreneurs frequently find themselves facing the question: "How to raise money for a business without a loan?" This question isn't born out of mere curiosity but necessity, and exploring the answers to it opens a vast horizon of non-traditional, yet effective ways to secure capital. This blog post aims to delve deep into this topic, shedding light on the multiple avenues businesses can pursue to fuel their business growth without indebting themselves.

The importance of this topic for businesses, particularly startups, and SMEs (Small and Medium Enterprises), is hard to overstate. Most businesses require raising money to start, grow, and compete. Typical bank loans, while providing immediate liquidity, also bring with them a burden of debt that can stifle growth and flexibility, especially in the early stages. For an existing business already operating on thin margins or those facing unstable market conditions, bank loan repayments can become a significant financial strain. Furthermore, businesses may face high-interest rates, and stringent repayment terms, or may not even qualify for loans in the first place. Hence, exploring alternatives to traditional loans becomes not just an option, but a crucial strategic move. Throughout this article, we will dissect a range of alternatives about how to raise money for a business without a loan.

Understanding Why Avoiding Loans Can Be Beneficial

Potential Downsides of Business Loans

Securing a business loan may seem like an easy solution to cash flow shortages or a need for investment capital, but this path comes with its share of drawbacks. One of the most significant downsides is the added financial pressure of loan repayments. This debt must be repaid regardless of your business's financial health, potentially constraining your company's cash flow, especially if the business encounters unexpected downturns or increased competition.

Secondly, interest rates can add a considerable amount to the total repayment sum. These interest payments represent an additional cost that could otherwise be directed toward investment in your business's growth. Furthermore, securing a loan often necessitates providing collateral - assets that can be seized if loan repayments aren't met, which adds an extra layer of risk to your operations.

Lastly, acquiring a loan can be a long and challenging process with strict credit checks and extensive documentation requirements. Small businesses or startups might find it difficult to qualify for a loan, and even when they do, the funds might not be immediately accessible.

Importance of Equity and Cash Flow Management

Equity and cash flow management are key pillars of any successful business. Retaining more equity in your business means maintaining greater control. It allows for more freedom in decision-making and long-term planning, as you're not beholden to a lending institution's terms and conditions or struggling to meet loan repayments.

Effective cash flow management, on the other hand, provides a business owner with the ability to cover expenses, invest in growth, and absorb financial shocks. Avoiding the commitment of regular loan repayments can ensure a healthier cash flow and, therefore, a more resilient and flexible business.

Potential Benefits of Alternative Funding Sources

Alternative funding sources can offer several advantages. They often allow businesses to obtain necessary funds without the burden of debt. For example, equity financing can provide capital in exchange for a share of the business, thus distributing the risk.

Sources like crowdfunding, grants, or strategic partnerships can also add value beyond the mere financial aspect. Crowdfunding campaigns, for instance, can simultaneously raise money while validating a business idea and building a community of potential customers. Grants usually come with no expectation of repayment or equity dilution. Strategic partnerships can offer resources like technology, expertise, or distribution channels, along with financial support.

Personal Investments

Personal investments, also known as "bootstrapping," refer to the process of financing your business using your own funds. These funds may come from personal savings, the sale of personal assets, or even from your regular income. Personal investments are critical, particularly in the early stages of a business when external funding might be difficult to secure. They demonstrate a clear commitment from the entrepreneur, showing potential investors that you believe in your business enough to invest your own money. It sends a strong signal of confidence in the business's potential for success.

Evaluating Your Own Financial Capacity

Before deciding to invest personal funds into your business, it's essential to evaluate your financial capacity. Consider your personal financial obligations and living expenses, and then determine how much you can realistically afford to put toward your business. It might be helpful to create a personal budget and a separate business budget to visualize your cash flow and determine where funds can be allocated most effectively. Consider consulting with a financial advisor to help navigate this critical decision and ensure you make the most informed choices.

Risks and Benefits Involved

Investing personal funds in your business carries both risks and benefits. The main risk is the potential for financial loss. If the business does not succeed, you could lose your investment and possibly endanger your personal financial stability. This risk underscores the importance of careful planning and a keen understanding of your tolerance for financial risk.

On the other hand, personal investments offer significant benefits. They allow you to retain full ownership and control over your business, as there are no external investors to answer to. This means you have the freedom to guide the direction of your business as you see fit. Furthermore, personal investments don't require interest payments or incur debt, leaving more cash flow available for business operations and growth.

Balancing these risks and benefits can be a challenging exercise. However, with careful planning and consideration, personal investments can be a powerful tool in your business funding strategy.

Crowdfunding

Crowdfunding is an innovative way to raise funds for a business or project, where a large number of people contribute small amounts of money, usually via the Internet. This form of fundraising has gained significant popularity in the digital age due to its simplicity and the direct engagement it offers between businesses and potential customers or backers.

Crowdfunding can take several forms: donation-based, rewards-based, equity-based, and debt-based. The most relevant forms for businesses are rewards-based, where contributors receive a product or service in return for their pledge, and equity-based, where backers receive shares in the company.

Top Crowdfunding Platforms for Businesses: *spotfund

Numerous crowdfunding platforms, such as GoFundMe and Indiegogo, have become prominent in the crowdfunding arena. Among these, one particularly beneficial platform stands out - *spotfund.

*spotfund stands out as a unique and innovative solution. Designed to democratize giving, *spotfund provides a free, straightforward, and powerful way for individuals and businesses to raise funds for causes and projects they're passionate about.

-

Fee-Free Fundraising: *spotfund sets itself apart by offering users the ability to start a fundraising campaign at no cost. This approach makes the platform accessible to a broad range of fundraisers, from individuals to startups.

-

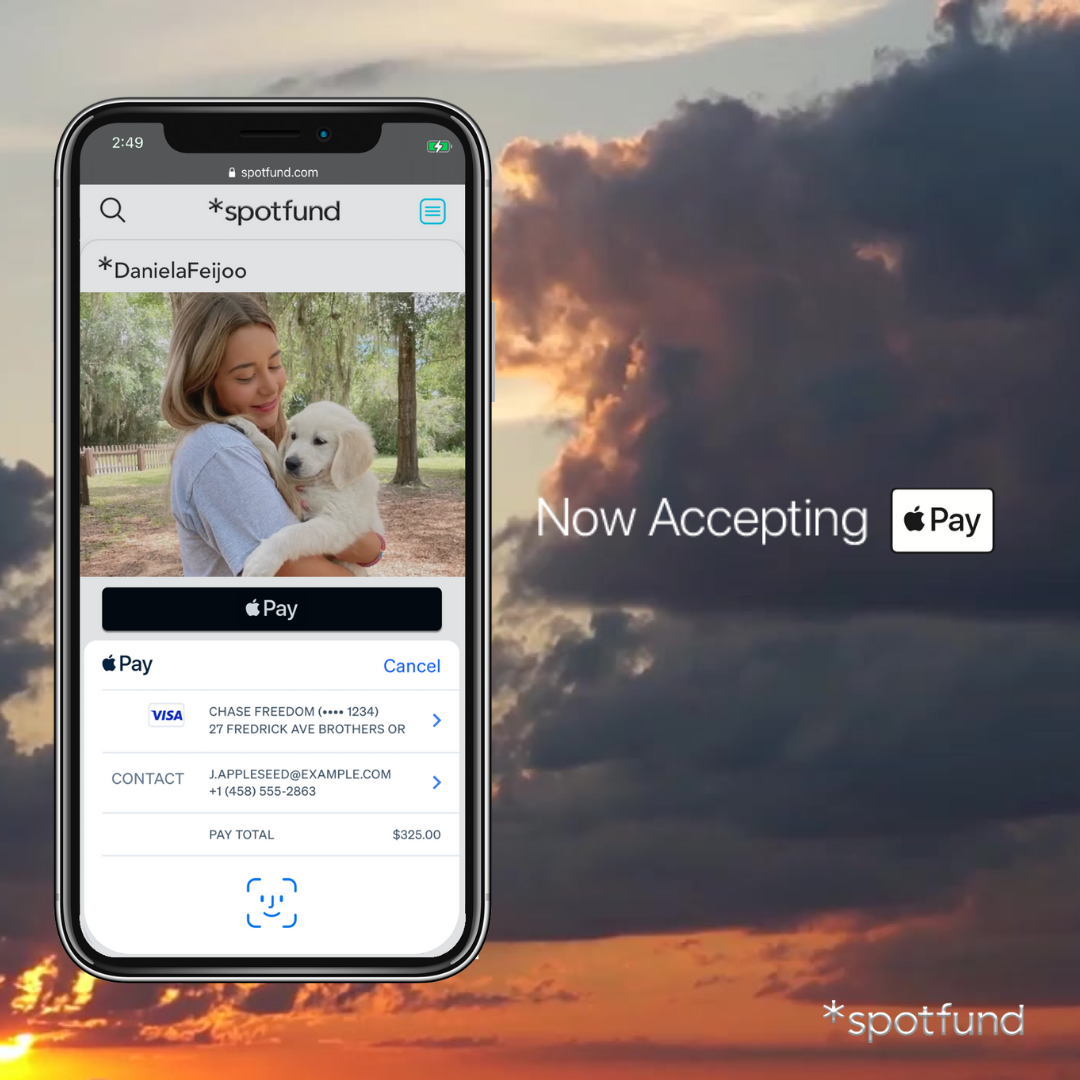

Secure Payment Methods: *spotfund integrates with Apple Pay, providing a highly secure, popular, and user-friendly method for contributors to make donations. This not only fosters trust but also simplifies the donation process, potentially boosting overall contributions.

-

Prominent Social Integration: *spotfund campaigns can be effortlessly shared across numerous social media platforms. This expands the reach of campaigns, allows fundraisers to leverage their existing networks, and aids in building a community around their cause or project.

-

Swift Access to Funds: *spotfund provides a prompt withdrawal feature, enabling fundraisers to access their funds as soon as donations start coming in. This is particularly beneficial for projects that require immediate funding.

Create a crowdfunding campaign for your business now!

Tips for a Successful Crowdfunding Campaign

Running a successful crowdfunding campaign requires strategy and preparation. Here are a few tips:

-

Clear and Compelling Story: Your campaign should tell a compelling story about your business or product. Make sure it resonates with potential backers.

-

Attractive Rewards: Offer enticing rewards or incentives that provide value to backers and incentivize them to contribute.

-

Effective Marketing: Promote your campaign aggressively using social media, email marketing, public relations, and more.

-

Regular Updates: Keep your backers updated throughout the campaign. Transparency builds trust and fosters a supportive community.

Potential Challenges and Solutions

Despite its potential, crowdfunding also poses challenges. One common challenge is not reaching your funding goal. To mitigate this, conduct thorough market research and set a realistic goal.

Another challenge is the risk of public failure. If a campaign doesn't succeed, it's publicly visible, which could affect the brand's reputation. Planning and preparation are crucial here - ensuring you have a robust marketing strategy and a high-quality offering can help ensure success.

Lastly, fulfilling rewards can be a significant undertaking, particularly for larger campaigns. Make sure you have a solid plan for production and distribution, and account for these costs in your campaign budget.

Angel Investors and Venture Capitalists

Angel investors and venture capitalists are two key types of equity financing that can provide significant capital for businesses, often in their early stages.

Difference Between Angel Investors and Venture Capitalists

Angel investors are typically high-net-worth individuals who provide financial backing for startups or entrepreneurs, usually in exchange for ownership equity. They might be professionals, successful entrepreneurs themselves, or individuals who simply have the financial capacity to invest. Angel investors often operate individually, but they may also form angel groups or angel networks to share research and pool their investment capital.

Venture capitalists, on the other hand, are usually members of a professional investment firm. These firms pool money from multiple investors into a venture capital fund, which they manage and invest in a portfolio of businesses. Venture capital is often associated with high-growth, high-risk industries such as technology and biotech.

The main differences between angel investors and venture capitalists lie in the scale of their investments, their involvement in the business, and their risk tolerance. Angel investors generally invest smaller amounts, often in very early-stage businesses, while venture capitalists typically invest larger amounts in businesses that have already demonstrated some level of success or growth.

How to Attract These Types of Investors

Attracting angel investors and venture capitalists requires a clear and compelling business proposition. Here are some key steps:

- Business Plan: Develop a comprehensive business plan, demonstrating a deep understanding of your market, competition, revenue model, and growth strategy.

- Strong Management Team: Show that your team has the skills, experience, and commitment necessary to execute your business plan effectively.

- Scalable Business Model: Demonstrate a business model that has the potential for high growth and substantial returns on investment.

- Value Proposition: Clearly articulate your unique value proposition, why your product or service is better or different from existing solutions, and why it will succeed in the market.

- Networking: Attend industry events, startup meetups, and other networking events where these investors are likely to be present.

Advantages and Disadvantages of Equity Financing

Equity financing offers several advantages. It doesn't require repayment like a loan, which can significantly reduce financial pressure on the business. Investors also bring their own expertise and networks, which can be invaluable for growth and strategic planning.

However, equity financing also means giving up a portion of the ownership of the business, which translates to sharing control and profits. Decisions about the business's future will need to be made collectively, and conflicts can arise if the investors and the original owners have differing views. The process of securing equity financing can also be time-consuming and complex, requiring careful due diligence and legal compliance.

Strategic Partnerships

Strategic partnerships represent an agreement or collaboration between two or more businesses with the aim of achieving mutual growth and success. These partnerships are formed when businesses realize that they can accomplish their goals more effectively by combining their resources, technology, or expertise, rather than competing against each other.

Strategic partnerships can take various forms, such as joint ventures, licensing agreements, and co-marketing initiatives. The underlying principle is that all parties benefit - whether it's by expanding into new markets, developing new products, sharing research and development costs, or increasing visibility among a partner's customer base.

How to Create Beneficial Partnerships

Creating a beneficial strategic partnership requires careful planning, alignment of objectives, and clear communication. Here are some steps to consider:

- Identify Potential Partners: Look for businesses that complement yours and can help you achieve your objectives. These could be businesses in the same industry or related fields.

- Align Goals: Ensure that the partnership goals are clearly defined and aligned between all parties. This includes agreement on the expected outcomes, resource allocation, and roles and responsibilities.

- Define the Terms: Formalize the partnership with a written agreement. This should cover all aspects of the partnership, including financial arrangements, division of tasks, confidentiality terms, and dispute resolution mechanisms.

- Maintain Open Communication: Clear and regular communication is crucial for the success of any partnership. Keep all partners informed about progress, challenges, and changes in strategy.

- Evaluate and Evolve: Regularly review the partnership's effectiveness against the set goals. Be ready to adapt the partnership as needed to ensure continued success.

Government Grants and Programs

Government grants and programs can provide valuable funding to businesses at all stages. These are often non-repayable funds provided by governmental bodies at various levels - local, state, or federal - to eligible businesses. The availability of these grants varies by industry, region, and the specific objectives of the programs.

Some grants are aimed at promoting innovation, such as those for research and development in technology or health sectors. Others aim to support economic development in specific regions or to promote sustainable practices, diversity, and inclusion in business.

Common types of government grants include small business grants, research grants, and grants for nonprofit organizations. Many government programs also provide other forms of assistance, such as loans, loan guarantees, tax credits, or technical assistance.

Qualifications for Application

Eligibility for government grants depends on a variety of factors. While specifics vary by grant, some common qualifications include:

- Nature of Business: Some grants are specifically for businesses in certain industries, such as technology, manufacturing, or agriculture.

- Business Size: Grants, especially those for small businesses, may have criteria based on the number of employees or annual revenues.

- Location: Certain grants target businesses operating in particular regions, especially those in need of economic development.

- Use of Funds: Grants often stipulate how the funds must be used. This can include expanding operations, hiring new staff, conducting research and development, or improving equipment or infrastructure.

- Compliance: Businesses must comply with all federal, state, and local regulations to be eligible for most grants.

Revenue-Based Financing

Revenue-based financing, also known as royalty-based financing, is a type of funding in which investors provide capital to a business in exchange for a percentage of the company's ongoing gross revenues. Instead of offering equity in the company or securing the loan with the company's assets, the repayment is tied to the business's income.

Typically, a company will pay the investor between 2% and 8% of monthly revenues. The payments continue until the business repays a predetermined multiple of the original invested capital, often 1.5 to 3 times the original investment amount.

When to Consider This Type of Financing

Revenue-based financing can be an appealing option for businesses in various scenarios:

- Revenue Generating: This type of financing is best suited for businesses that have consistent monthly revenue. As repayments are a percentage of revenue, the business needs to be generating sales to afford repayments.

- Looking for Non-Dilutive Capital: If business owners do not want to give up ownership equity or control of their business, revenue-based financing can be an attractive option.

- Scalable Business Model: Companies with a high-margin, scalable business model can effectively utilize this type of financing to fuel their growth.

- Short-term Capital Need: For businesses in need of capital to finance an inventory purchase, launch a new product, or expand into a new market, revenue-based financing can provide the necessary funds without the long-term commitment of a traditional loan.

Pros and Cons of Revenue-Based Financing

Like any financing method, revenue-based financing has its advantages and disadvantages:

Pros:

- No Equity Sacrifice: Unlike venture capital, you don’t give up any ownership of your business.

- Flexible Repayment: Payments fluctuate with your sales, making it easier in slower months.

- Quick Access to Capital: The application and approval process is often faster than traditional loans or venture capital.

Cons:

- Higher Cost of Capital: This type of financing can be more expensive than traditional loans due to the risk assumed by the investor.

- Revenue Requirement: Your business needs to be generating consistent revenue to afford the repayments.

- Potential to Stifle Growth: If a large portion of revenue is used for repayments, it might limit available funds for growth activities.

Conclusion

Finding ways to raise funds for your business without relying on traditional loans can be a challenging task, but it's certainly not impossible. From personal investments, bootstrapping, and crowdfunding to securing angel investors, venture capitalists, or government grants, there are myriad options available. More innovative approaches, like strategic partnerships and revenue-based financing, can also provide valuable resources to finance your business operations and growth.

Remember, every business is unique, and what works for one might not work for another. Therefore, it's essential to assess each funding option carefully, considering your business model, financial situation, growth plans, and risk tolerance.

By exploring these alternative funding strategies and understanding their advantages and disadvantages, you can choose the one that best suits your business. This way, you can secure the necessary funding for your business, fuel your growth, and maintain control of your company while minimizing debt.

Are you ready to fuel your business's growth and bring your vision to life? Start your crowdfunding journey with *spotfund today!